Typical Depreciation Assets

Savvy investors look to maximise their return on their investments to enable them to reinvest or improve their properties, creating a successful property investment portfolio and strategy for growth.

Understanding the value of depreciation as a tool to offset your investment expenses, and reduce your taxable income is essential.

At NBtax we ensure all eligible deduction items are incorporated in our assessment, including those less obvious or unseen.

Below are just some of the items we look for when calculating depreciation allowances.

Checklist of Typical Depreciation Assets

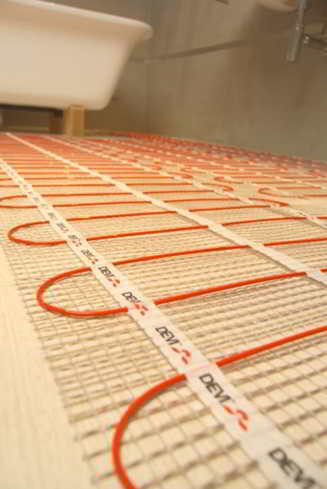

- Fixed heating appliances (air conditioners, hot water systems, heaters, solar panels)

- Kitchen (cooking appliances, exhaust fans, dishwasher)

- Laundry (washer, dryer)

- Flooring (carpet, timber floors panels)

- Window coverings (blinds, curtains)

- Bathroom (fans, dryers, spa pump, ventilation)

- Fire control (smoke detectors, extinguishers, hose reel pump, phone)

- Security System (CCTV cameras, swipe card entry, controls, door entry, garage door motor etc)

- Additional external fixtures (mobile BBQ, gym, pool & equipment, synthetic tennis court, sauna equipment, car stacker, pumps)

- Lifts in apartment building